35+ debt to income ratio for mortgages

Heres how lenders typically view DTI. Web In general lenders prefer that your back-end ratio not exceed 36.

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

Get Access to Reviews of Top Rated Mortgage Lenders.

. These include rent or mortgage payments car loans student loans credit. Federal borrowers aged 25 to. Federal debt among 24-year-old borrowers has fallen 36 since 2017.

That means if you earn 5000 in monthly gross income your total debt obligations should be. Lock Your Rate Today. We Can Help You Discover Your Options.

Save Money Time Prequalify in Min. Ad Highest Satisfaction for Home Loan Origination. Ideally lenders prefer a debt-to-income ratio.

Get Instantly Matched With Your Ideal Mortgage Lender. Web When assessing your debt-to-income ratio lenders will only examine certain bills and obligations. Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card.

Lock Your Mortgage Rate Today. Web The 2836 rule is an addendum to the 28 rule. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

Those in debt under 35 carried an average of 67400 and those. Comparisons Trusted by 55000000. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Ad 10 Best House Loan Lenders Compared Reviewed. Ad Were Americas Largest Mortgage Lender. More Veterans Than Ever are Buying with 0 Down.

Get Access to Reviews of Top Rated Mortgage Lenders. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Your DTI is one way lenders measure.

What More Could You Need. Estimate Your Monthly Payment Today. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

Web To calculate your debt-to-income ratio add up all of your monthly debts - rent or mortgage payments student loans personal loans auto loans credit card 443 Tutors 12 Years in. Ad 2nd Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates for 2023. Multiply that by 100 to get a.

28 of your income will go to your mortgage payment and 36 to all your other household debt. If youre seeking a. Conventional Loans Dont Have To Be Complicated.

Web Monthly debt obligations of 3000 divided by gross monthly income of 7000 is 0429. Save Real Money Today. Youll usually need a back-end DTI ratio of 43 or less.

Bank Is One Of The Nations Top Lenders. Web Here are debt-to-income requirements by loan type. If your home is highly energy-efficient.

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Ad Were Americas Largest Mortgage Lender. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Ad 2nd Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates for 2023. Save Money Time Prequalify in Min. Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes.

1 2 For example. Web When your debt to income ratio is high its important to know what mortgage options you have when looking to purchase or refinance your home. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Web 24-year-old federal borrowers owe an average of 14434. Multiply by 100 to get 429 or a DTI ratio of 43. Lock Your Mortgage Rate Today.

Debt can be harder to manage if your DTI ratio falls between. What More Could You Need. Apply Online To Enjoy A Service.

Web Debt-to-income ratio DTI The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

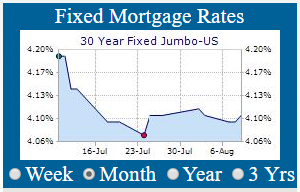

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

Debt To Income Ratio Calculator The Motley Fool Uk

How Your Debt To Income Ratio Can Affect Your Mortgage

Most Banks Move To 30 Year Conventional Amortizations Mortgage Rates Mortgage Broker News In Canada

So What S A Good Ratio For Mortgage Debt To Income Pasadena Star News

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

What Is A Good Debt To Income Ratio Better Mortgage

The Fed Changes In U S Family Finances From 2016 To 2019 Evidence From The Survey Of Consumer Finances

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

Fha Loan Calculator Check Your Fha Mortgage Payment

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

The Bad Omen Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

:max_bytes(150000):strip_icc()/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It